My role

Design Lead

Date

Apr-Oct 2022

Tools used

Figma

Figjam

Attest

Usertesting.com

Team

Karl Koch, Product Designer

Spyri Oikonomou, UX Researcher

Victoria Palmer, Senior Product Manager

Smith Forte, Chief Product Officer

Context

Problem

There are over 18m people in the UK with £10,000 or more in low-interest savings or current accounts.

We believed that these people would benefit from financial advice, a service largely misunderstood and mistrusted by the general public.

Solution

If we could provide free, quality financial advice for all Moneybox customers, that would be a significant disruptor in the UK savings & investments market.

By bringing financial goals, guidance and advice to the heart of the Moneybox experience, we could reframe the way customers think about saving; through the lens of ‘their financial future’ rather than the existing product-led approach.

Note: This project was an extension of the Goals project I worked on, and was unfortunately cancelled after around 6 months due to a change of focus for the business. However, the research and discovery we produced was very insightful and worthy of further discussion.

Research

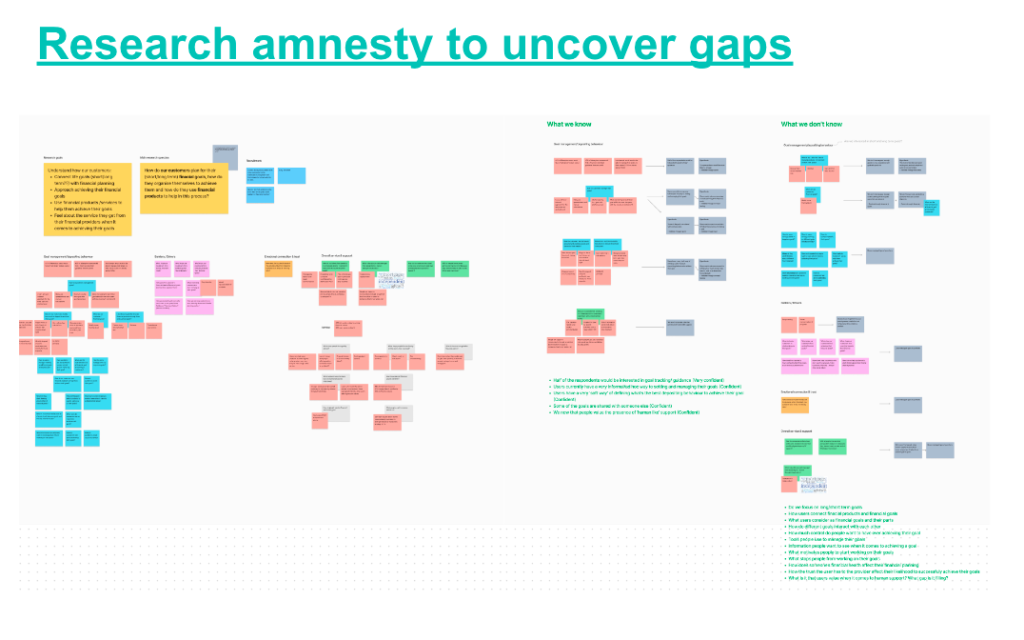

Amnesty

As mentioned in the Goals case study, some research had been done by the team before Spyri or I joined the company. The first stage was to look through the existing materials and identify what we knew, and what gaps still remained. Spyri took on the results of a survey that had been sent out, while I covered the competitor analysis.

Concept testing

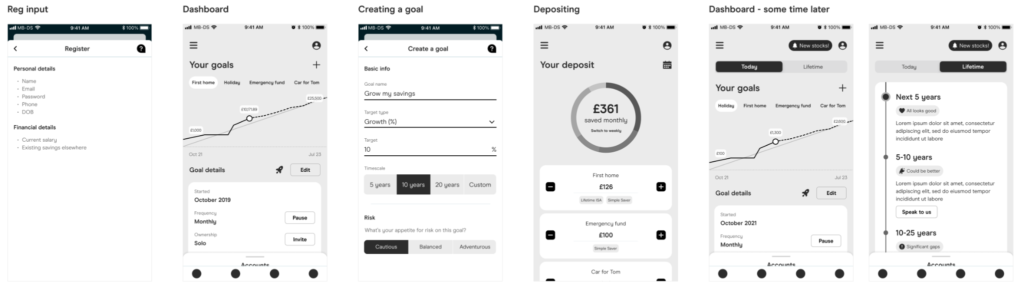

Once we had a good idea of how to proceed, I created a set of visual concepts which we tested with a group of customers.

Level of control

The main parameter we were testing with these concepts was ‘how much control do you want to have over your financial goals?’

I created two concepts at either end of this spectrum; one which was very hands-off, automated and abstracted. Customers would have little interaction or knowledge of things at a product level, everything would be done based on their individual savings goals.

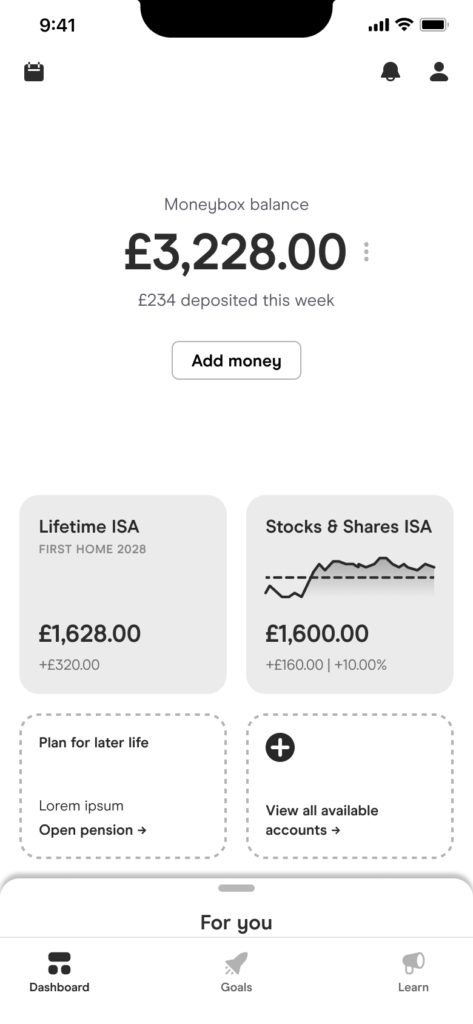

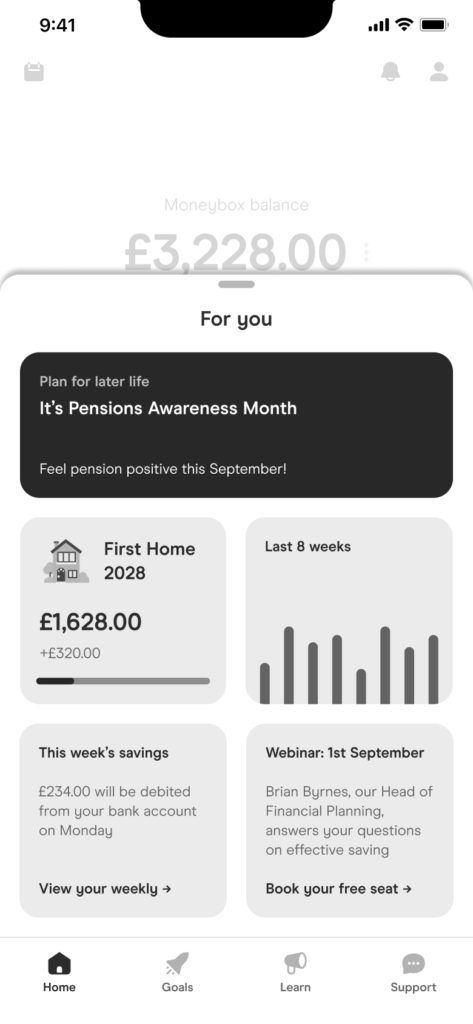

The other concept, shown below, placed complete control in the customer’s hands. They would be able to pick their accounts, assign goals to them, adjust projections and interact with their goals on a much deeper level.

This concept was the overwhelming favourite – customers didn’t seem to like the idea of being totally hands-off with their money and the format didn’t align with how they perceived longer-term goals in general.

Survey

The results of this test were well received, but bias was a concern as we were only speaking with our existing customers.

I wrote a survey with input from Spyri, which we sent out to 500 non-customers and 350 customers.

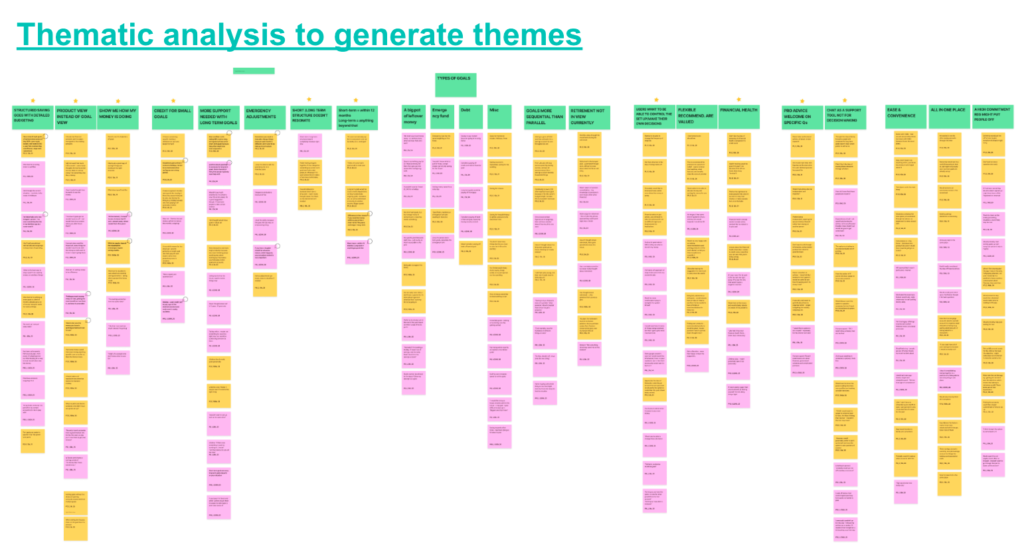

Analysis & playback

Once all our findings were in, Spyri analysed and collated the results which were then presented back to our steering committee.

Discovery

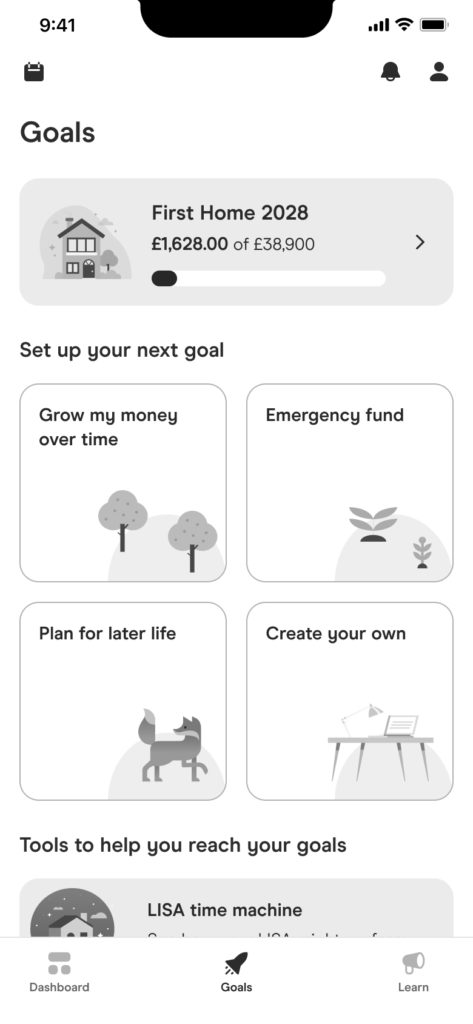

The initial testing highlighted four main themes for features that test participants were looking for:

Recommendations

Help me understand my goals; tell me which accounts are right for me; how much should I save given my situation?

Account performance

How much money have I saved? How much interest/gains/bonus have I earned?

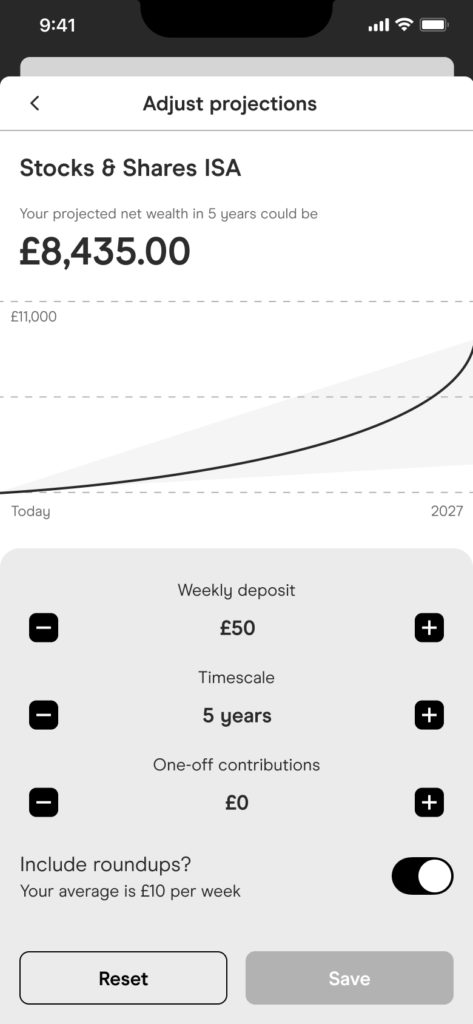

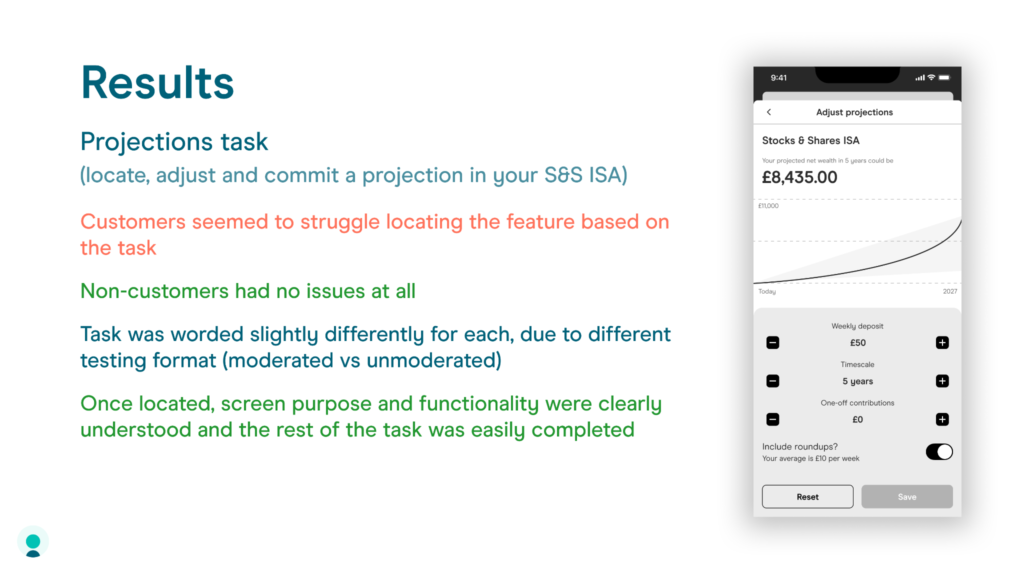

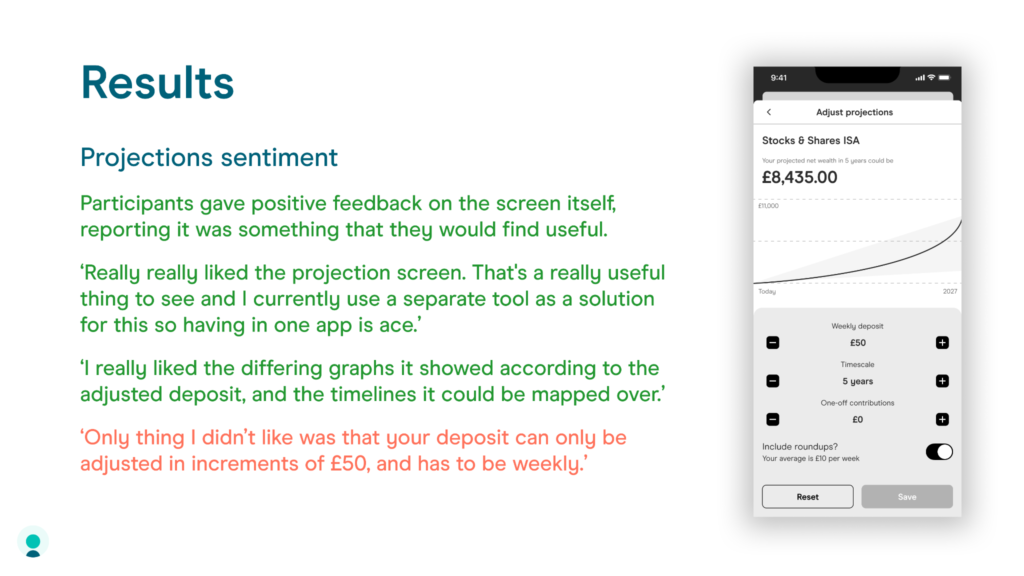

Projections

If I save £x into my accounts each month, what could that look like in x years?

Human guidance

I’d like to speak to a real human regarding my goals and how to approach my finances

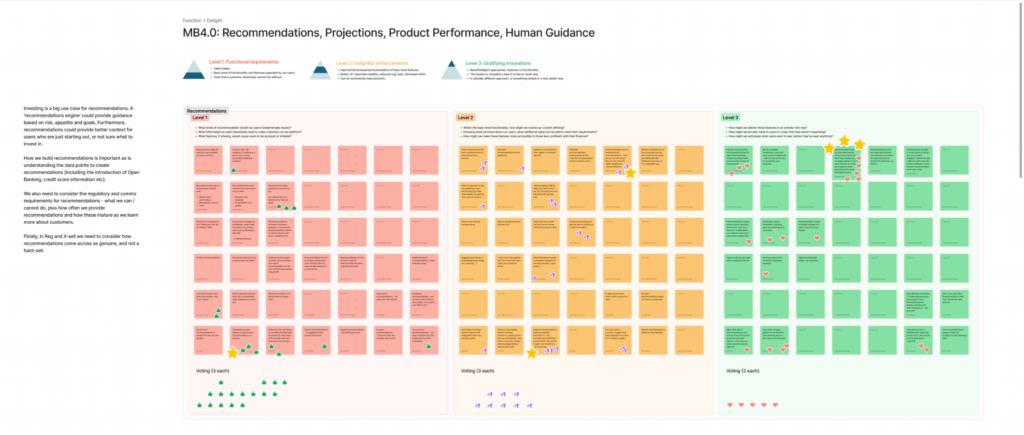

Ideation workshops

I organised a set of four workshops with these themes in mind – I invited a selection of designers, product managers, engineers, subject-matter experts and compliance officers. Together, we identified a number of features that we would take through to initial designs – from ‘table stakes’ fundamentals to real differentiators.

Prototyping

I put together a prototype in Figma to start bringing these feature ideas to life, with the idea of testing it iteratively with customers and non-customers to validate our assumptions.

Could they locate the features I had designed, and did they work as expected? With each test I set three task scenarios, layering on another three each time.

I tested with 6 customers and 6 non-customers; customer tests were moderated usability tests that took place on video calls, while non-customers were unmoderated and conducted async via Usertesting.com.

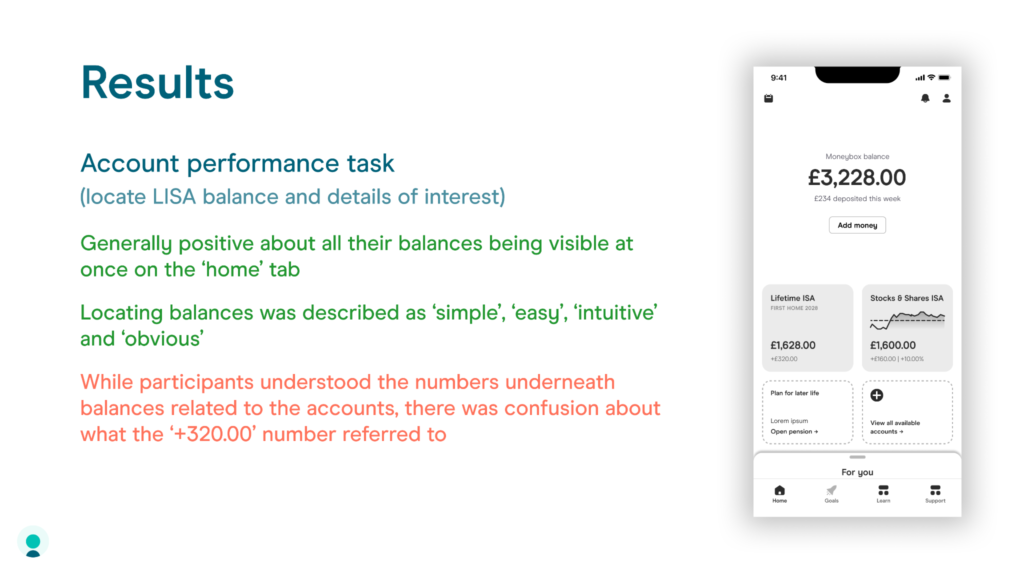

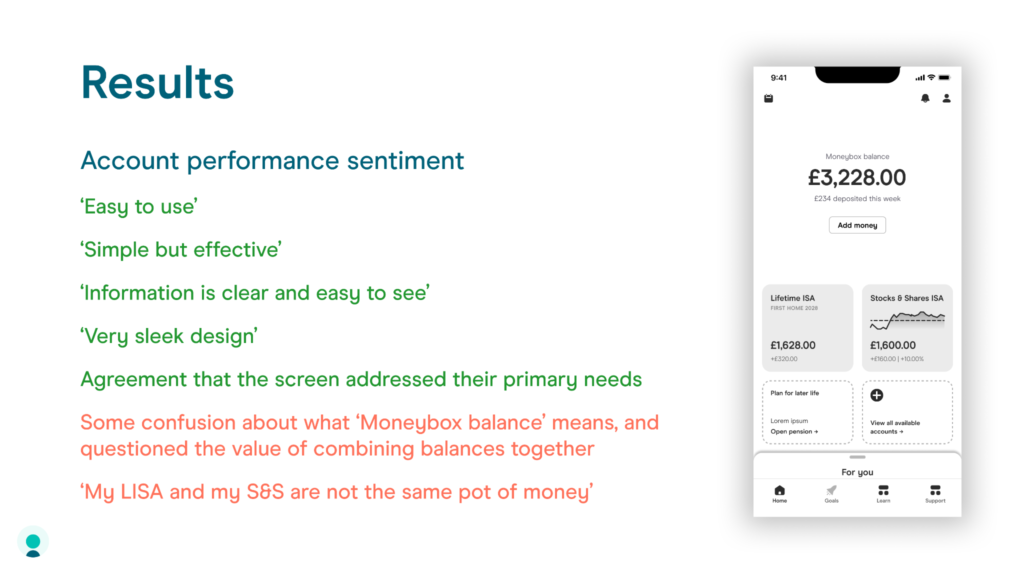

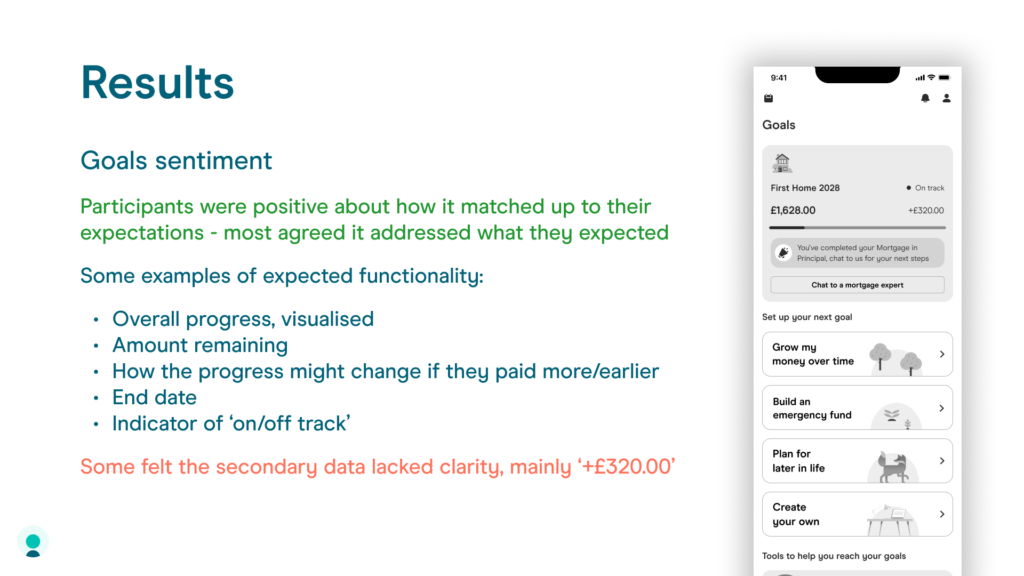

Results

Feedback from all participants was generally positive, and raised some important points about making sense of the numbers. However, I feel that if this were your own account you’d be more familiar with how much you’d saved, rather than seeing them for the first time in a test scenario.

End of the line

The next phase of the prototyping was due to focus on:

- Experience of single-account holders

- Creating product ‘hubs’ for each account type (savings, investing, retirement, homebuying)

- A holistic ‘lifetime view’ of all your goals in one place

However, progress was halted and eventually shelved at this point, due to changing priorities within the senior leadership team.

System thinking

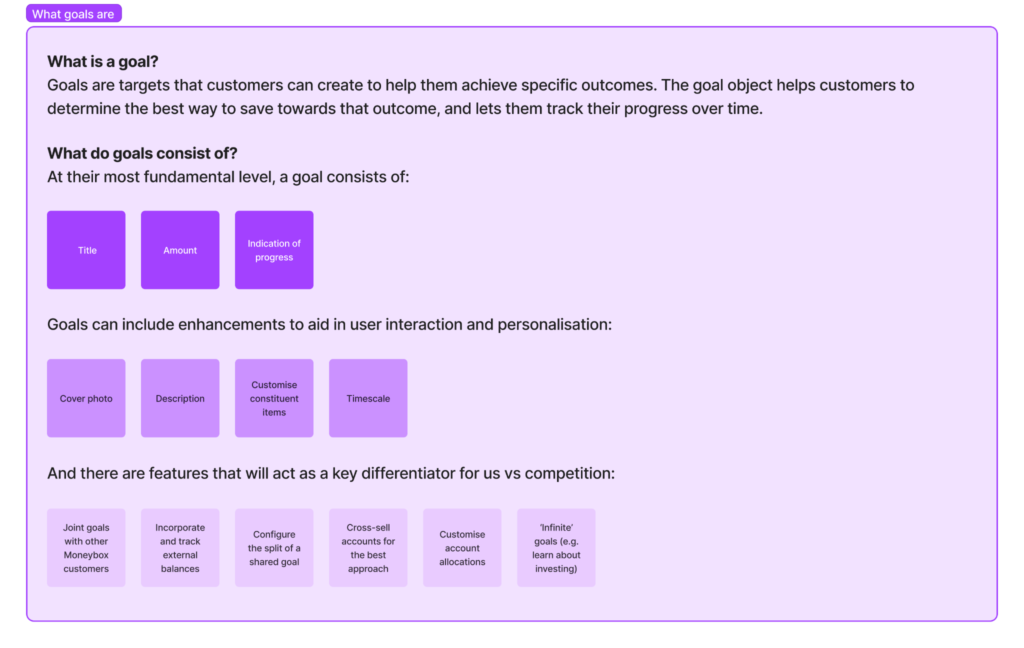

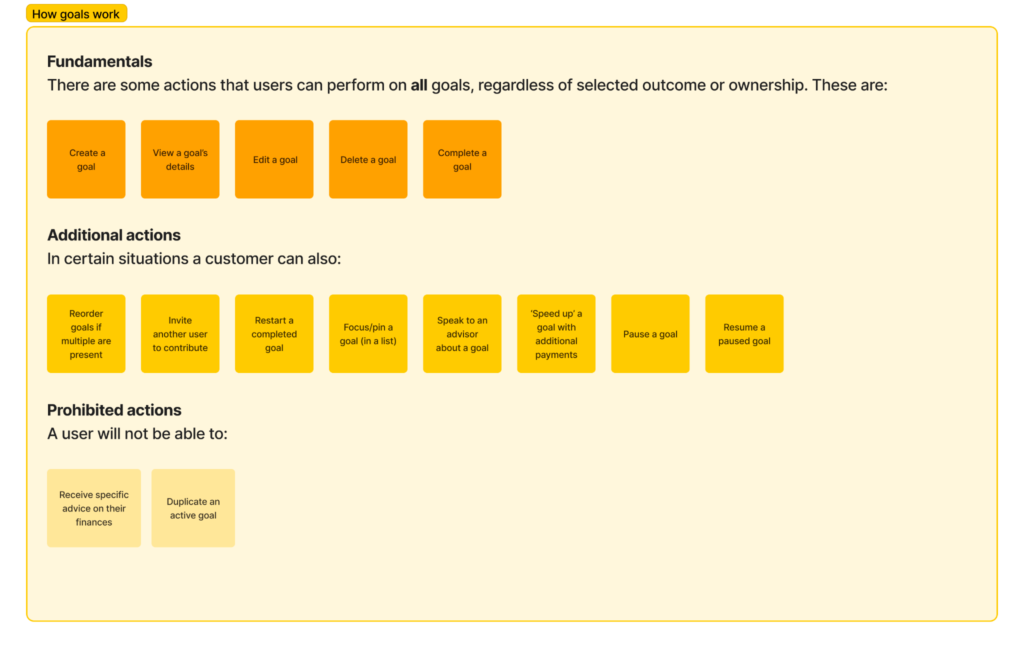

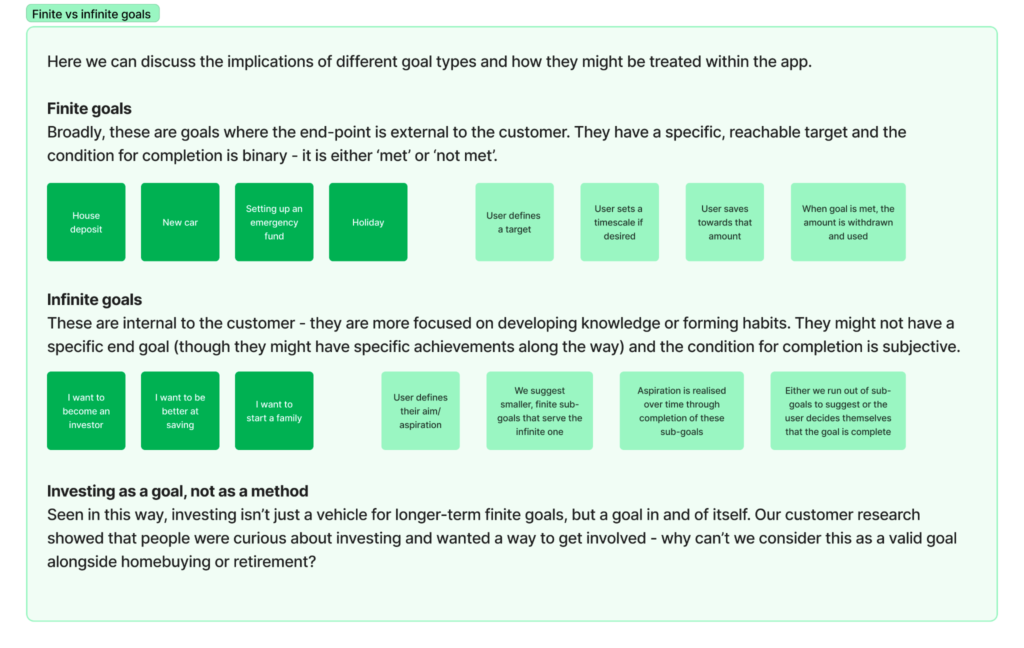

Alongside the work above, I spent a lot of time thinking about how this experience would work and scale as a system of parts, that would likely evolve over time as new products and new customer types came into play.

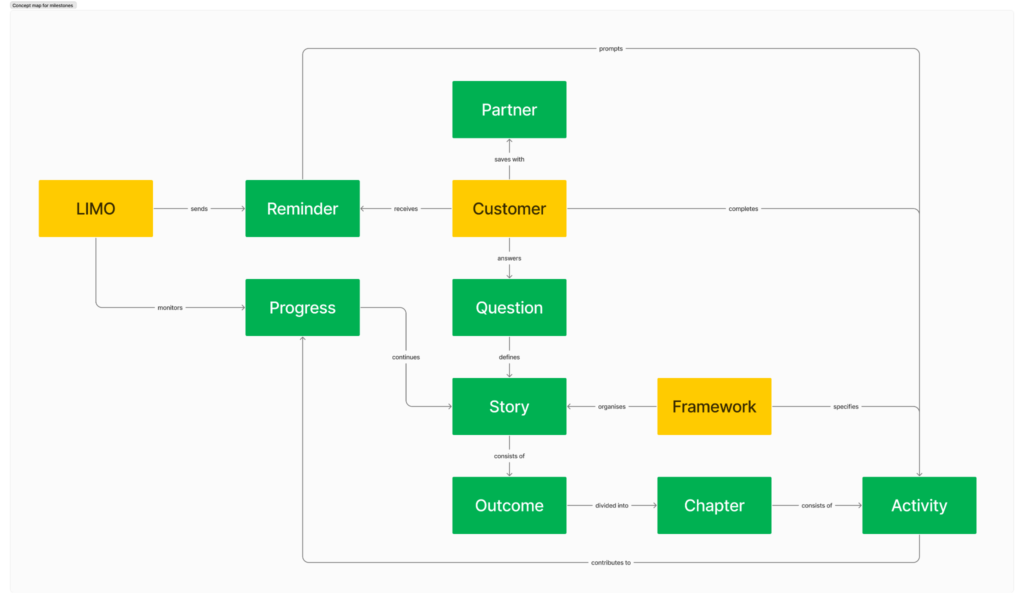

Definition & specification

This project involved a lot of different objects, all with their own unique attributes and relationships.

Having a fundamental specification for your product, and establishing rules for how they will interact, helps to make sense of the moving parts, and makes it easier to diversify and scale over time.

It also approaches the problem with more of an engineering mindset which makes early collaboration much better.

I identified a range of attributes here, from simple (create, read, edit, delete) to more nuanced qualities like sharing permissions, ownership, progress structure and the very nature of the goals themselves.

System design

I also completed some function mapping, to see all of the related objects together and define how they relate to one another.

Structural concept

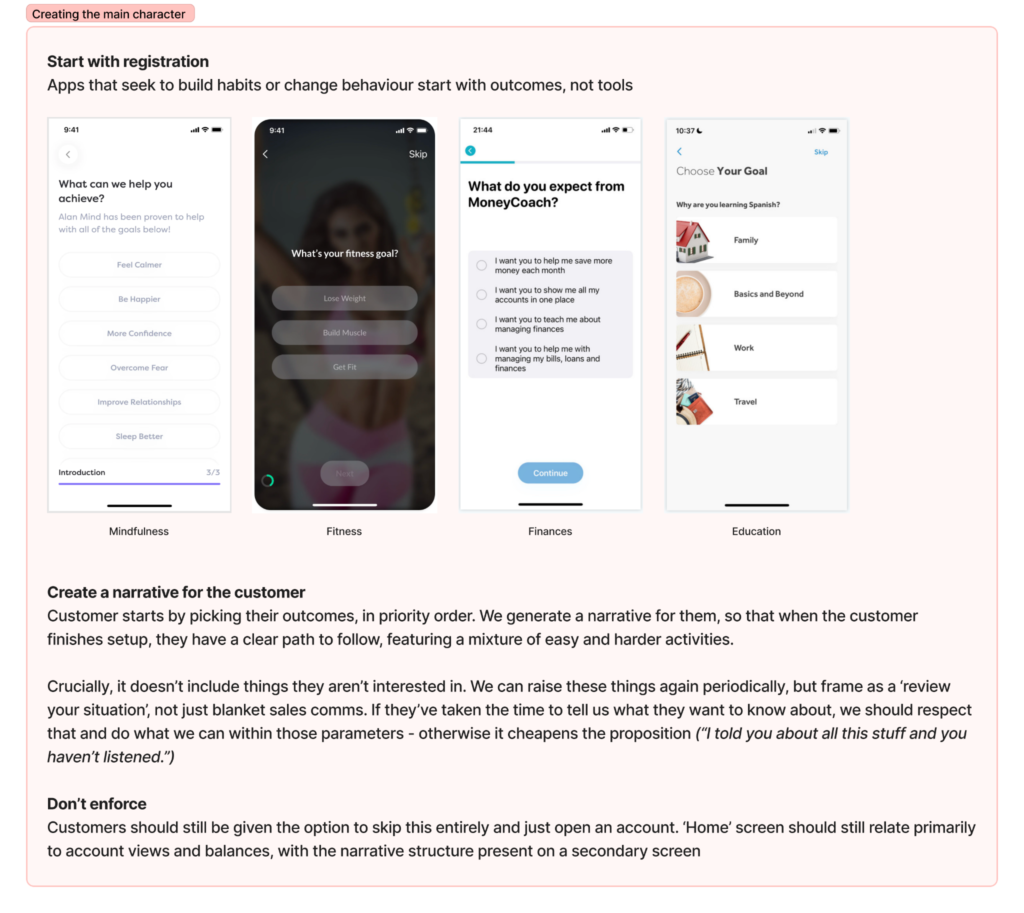

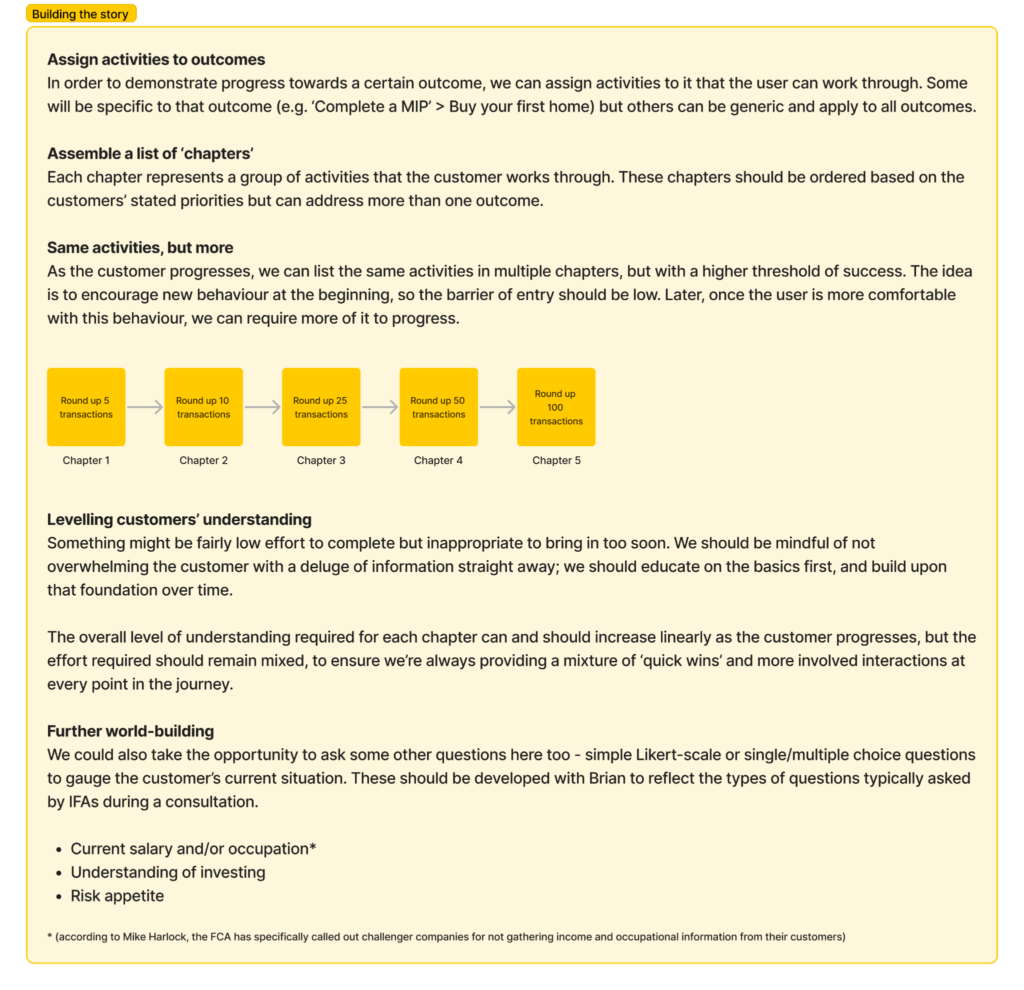

I was keen to avoid the idea of gamification for this project:

- Superficial approach – work hard to save and receive a shiny badge!

- Same rules for everyone – fixed system unsuitable for people with varying goals

- Sense of ‘incompleteness’ – inadequacy, negative attitude for some

- “80% complete” – not true if the customer has done everything they deem to be valuable

As an alternative, I proposed the idea of a ‘narrative’ – more akin to a story archetype with a loose, flexible structure that can cater to a variety of different persona types. Actions and accounts can differ per customer, but the delivery and progression mechanisms can be the same.

Learnings

While disappointing that the project was shelved, it still taught me a lot about the overall product design process within teams, and how we as designers can lead the way by demonstrating best practice and ensuring alignment on overall goals throughout.

In this instance, the home-buying goal didn’t perform as well as hoped, and as it was seen as an MVP of sorts, the validity of the wider idea was brought into question. Understanding of the wider aims seemed to get lost over time, and research-led product development is still a fairly new concept, particularly for teams in the start-up/scale-up space where projects are often stakeholder-led.

Aspects of this work were later resurrected within other teams in early 2023, showing that the original idea was sound and had we stuck to it, we could have been in a great position to launch much sooner.